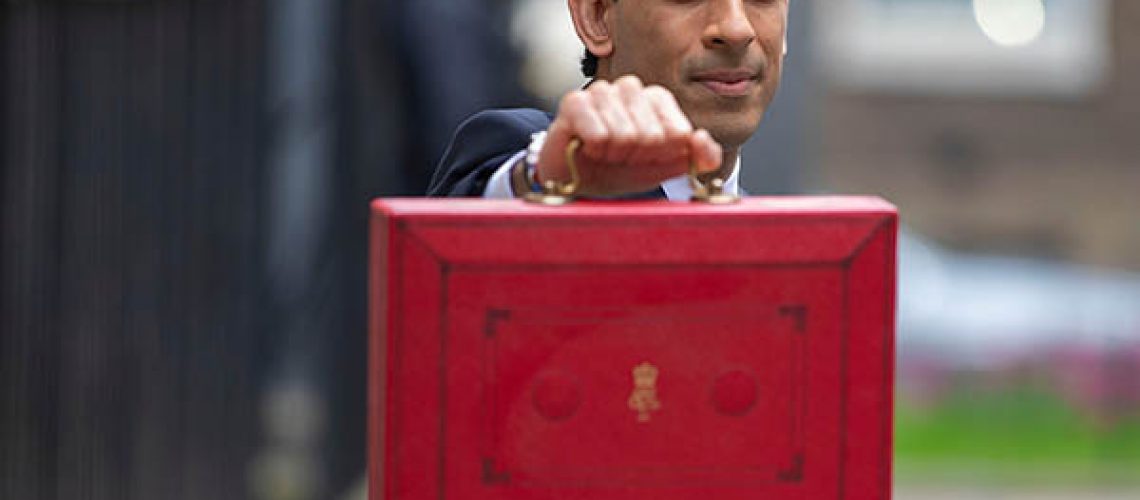

The Chancellor delivered his Budget yesterday. There were fears over stiff capital gains and other tax rises, plus expectations of handouts for businesses. What did Mr Sunak actually announce and how might his new tax measures affect you?

Below is a summary of the Budget tax announcements. Later this month we’ll be publishing our annual tax update report which will include more information, analysis and advice about these and other changes for the 2021/22 tax year and beyond.

In the meantime, here are the highlights of what the Chancellor announced in his Spring Budget 2021:

Coronavirus Support

- the Coronavirus Job Retention scheme (furlough scheme) will be extended until the end of September 2021. From an employee’s perspective nothing will change but employers’ contributions will increase starting in July

- the fourth tranche of the Self-Employment Income support Scheme will go ahead and there will be a fifth on similar terms. Those who have submitted their 2019/20 tax returns will be able to make a claim

- Working Tax Credit claimants will also be given more support for the next six months, with a one-off payment of £500

- the temporary £20 per week increase in Universal Credit will be extended by six months

- a new restart grant of up to £6,000 per premises for non-essential retail businesses in April and up to £18,000 for firms that open up later

- a new business loan scheme for all business offering 80% government guaranteed loans between £5,000 and £10 million.

Business Tax

- corporation tax will return to a two-tier system from April 2023 when:

- the rate of corporation tax will rise to 25% for companies with profits exceeding £250,000

- companies with profits up to £50,000 will continue to pay 19%

- companies with profits between £50,001 and £250,000 will pay tax at 25% reduced by marginal rate relief rate so that the main rate won’t apply until their profits excess the higher amount

- businesses will be allowed to carry back trading losses to set against tax paid on profits of the previous three years

- from April 2021, the new super-deduction (we assume this is an enhanced capital allowance) will cut companies’ tax bills by 25p for every pound they invest in new equipment.

- VAT will remain at 5% until 6 September and then an interim rate of 12.5% until 31 March 2022 for hospitality and tourism businesses

- VAT registration threshold will remain at £85,000

- consultations on R&D relief and the enterprise investment scheme will look at ways of improving their tax incentives.

Personal Tax

- the temporary increase to the stamp duty land tax nil rate band for dwelling of £500,000 will be extended until the end of June 2021. It will then fall to £250,000 until the end of September when it will return to its normal level

- personal allowances for 2021/22 will increase as planned to £12,750 but will then stay the same until April 2026

- the higher rate tax threshold will rise to £50,270 for 2021/22 but will also remain the same until April 2026.

Other Measures

- some businesses will be given incentive payments of £3,000 for all new apprentice hires of any ages

- starting from 4 March first-time buyers will be allowed to take 95% mortgages (i.e. only a 5% deposit will be required) backed by a partial government guarantee.

The devil will no doubt be in the detail of the Budget documents.